Trump’s Ban On Investors Buying Single-Family Homes Will Never Happen — And It’s Pointless Anyway

Ask me what I really think.

Two weeks ago, President Donald Trump — who apparently had some free time from invading Venezuela and Minnesota and threatening Greenland — proclaimed that he wanted to ban large institutional investors from buying single-family homes.

In a post, Bernie Sanders — I mean Trump, wrote that he was “immediately taking steps to ban large institutional investors from buying more single-family homes, and I will be calling on Congress to codify it. People live in homes, not corporations.” The New York Times reported that Trump’s proposal was being considered as part of a larger focus on housing affordability, which could include executive actions or legislation. Following that, the “details” subsequently came out, but things are still hazy — basic definitions such as what exactly an institutional investor or a single family home are have yet to be defined. NPR noted “Wall Street-backed landlords a target for both Trump and Democrats.”

Trump is echoing a point made in the pages of Jacobin magazine and by anti-monopoly writers like Matt Stoller.1 It’s one of those ideas that unites everyone from Vice President JD Vance to your dirtbag left friend who lives in Silver Lake and listens exclusively to the Red Scare podcast. (The number of local elected officials who have rambled on about corporations buying homes numbers in the thousands.)

So is this a great idea? Or actually a terrible one?

It’s neither. As usual with Trump, it’s a distraction.

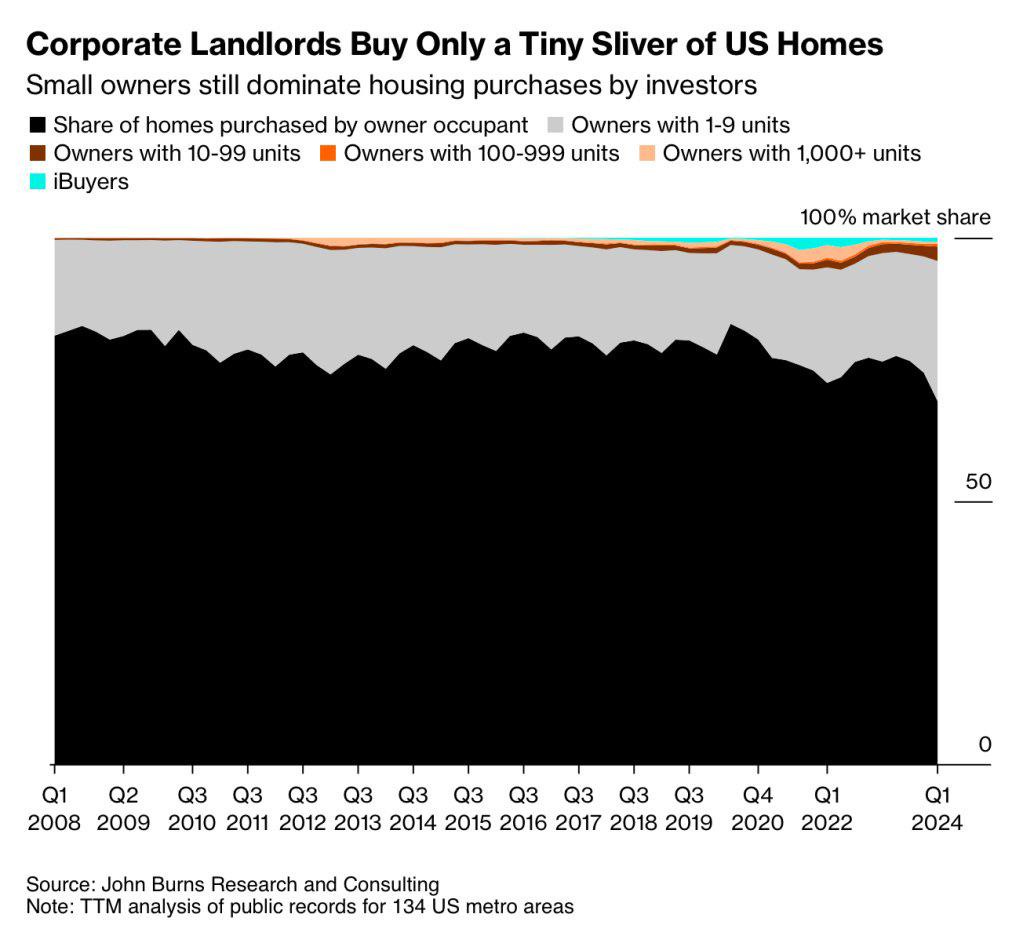

To be fair, there’s a thread of logic here. Housing prices are high — up 55% over the last five years, according to the National Association of Home Builders. “Investors” own about 20 percent of the nation’s single-family home. But the trouble is that “investors” is a much broader category than “institutional investors.” Investors include everyone from Blackstone to your rich uncle who rents out two or three properties in the neighborhood.2

Narrowing it down to large institutional investors like Blackstone shrinks us down to just two percent of all investor-owned single-family homes — something like 0.4% of the single-family homes in the country. So eliminating institutional investors from the market entirely wouldn’t domuch to put a dent in home prices.

Even if corporate landlords owned ten times the supply, the effect wouldn’t be that much. Once they buy a property, they are renting it out, moving the unit from one part of the overall housing market to another part of the overall housing market. Are they marginally better at squeezing rents out of renters? Much better than “mom and pop” landlords? The numbers don’t bear that out.

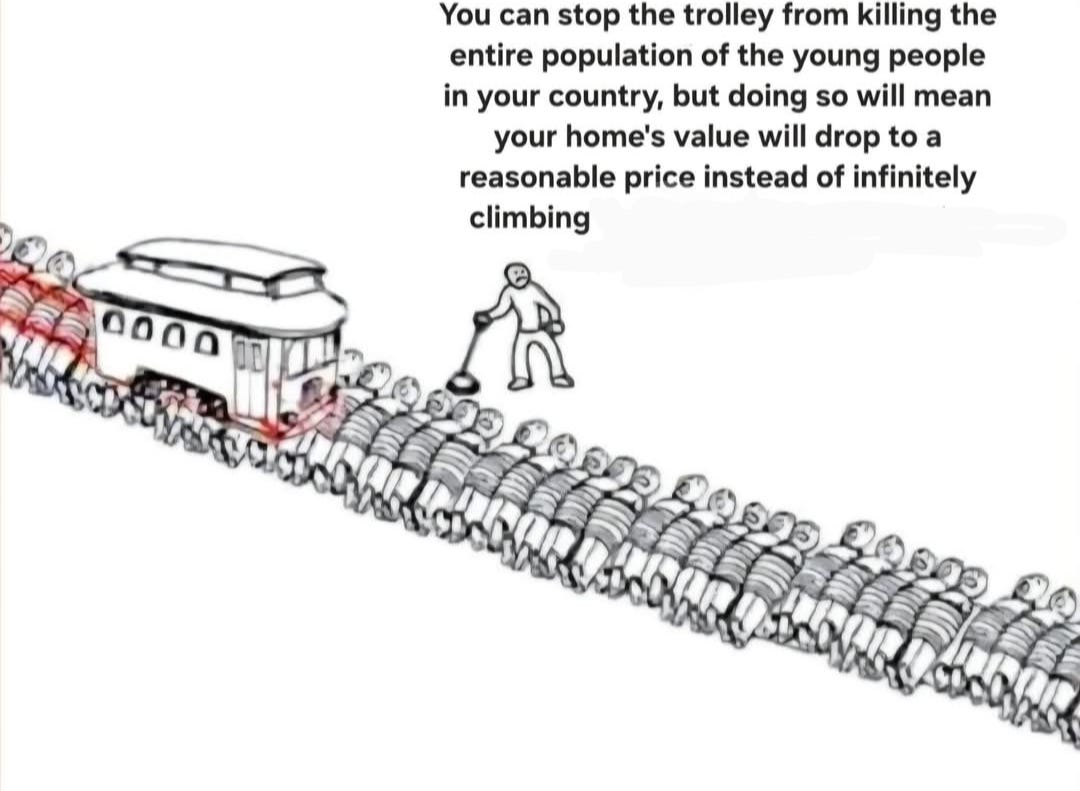

Fundamentally, why wouldn’t removing institutional investors from the market have a bigger impact? Because corporate landlords are a response to the housing crisis, not the cause of it. I’m going to repeat that a little louder for the people in the back: Wall Street is buying up houses because they think they can make money. They think demand will outstrip supply for years to come.

The investor class — which can put its money wherever it thinks will make the most profit — sees an artificially constrained asset that is unlikely to have new entrants delivering on supply and thinks what a great investment. They look at all the NIMBY-run city councils and say “These dumbasses are not going to allow competition. I should buy now!” In other words, what do you do when demand consistently outstrips supply? Gobble, gobble, gobble!

How do we know this is the case? Blackstone says so: “Rents are going up because there is significantly less supply of housing across the globe than demand for it.”

Institutional investors are the squawking canaries in the coal mine — they are a signal of the shortage, not its cause. Hot take: housing should be less like diamonds and more like potatoes. Plentiful, cheap, and if you want to charge a lot for them, they need to be au gratin.3

So, why is Trump (who is not exactly anti-corporate) fear-mongering about this corporate bogeyman?

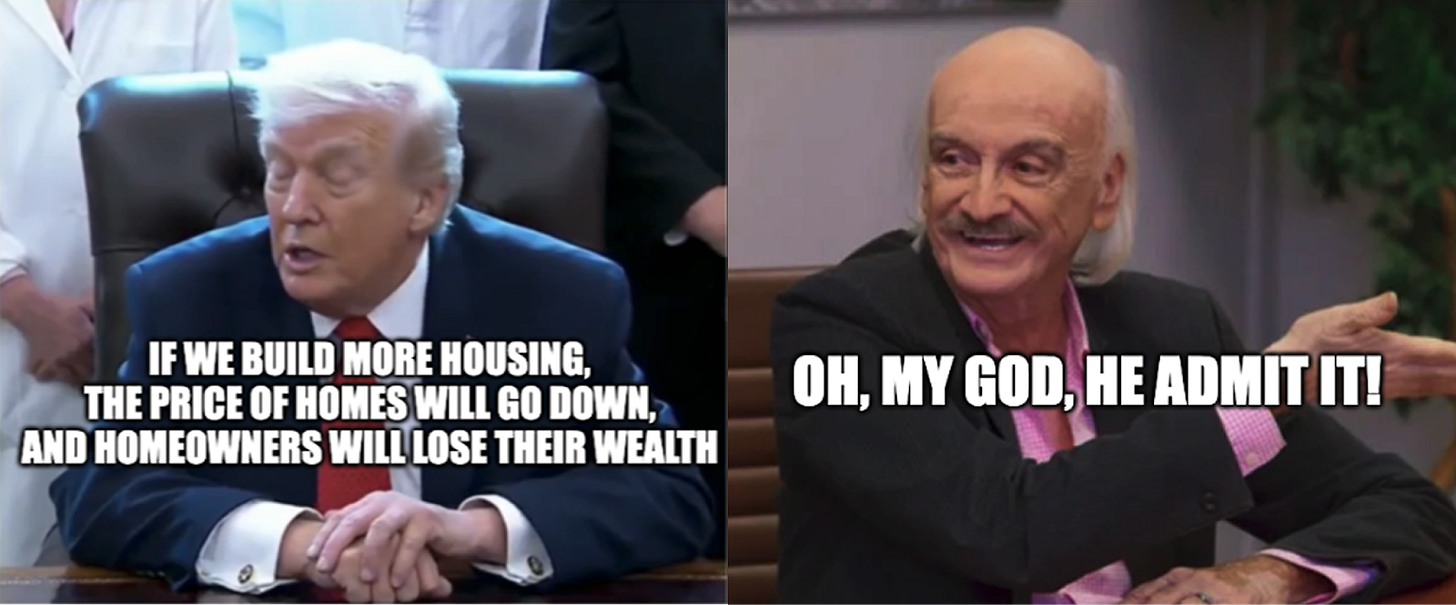

Part of it is because if you talk about supply, you frighten homeowners into thinking their property values won’t just keep going to infinity and beyond. He said out loud, as he often does, that if we were to build more housing, prices would come down, and homeowners would lose that wealth.4

Ok, but here’s my even hotter take. Literally none of this matters.

It’s incredibly likely that this is yet another shake-down of corporate America designed to line Trump’s personal pockets. Folks should be familiar with this game: Trump makes some big public moves that will hurt somebody’s interests. Those rich people quickly schedule time with him at Davos — or better yet Mar-a-Lago — to talk him down. Money will conveniently be deposited into bank accounts, commitments for fealty will be made, and just like that, the issue will disappear.

As a leftist who plays a corporate shill, I will also point out that corporations owning physical assets is great if you want to tax, regulate, or even seize those assets. If you are against monopolies, as I am, the best thing you can do is to encourage competition and investing in visible assets.

Kicking all the “investors” out of the single family home market would have another effect — it would mean fewer single family homes available for rent, which would make neighborhoods even less economically integrated, since down payments are a bitch. *screams in millennial*

Sidenote: The American Dream is tied up in home ownership as if that is a value in and of itself. It isn’t. It’s something that we give a lot of tax benefits to, but renting is an equally valid, if not better choice, for many people. That’s why we need strong tenant protections and better financial products for renters. There’s a whole thread to be pulled on here about how our federal policies reward owners and punish renters. Feel free to rant about it in the comments.

Yes, I know that building more supply does not have a clear impact one way or the other on land values. Do not send me your white papers on how multifamily construction means that per-unit costs can go down while land values stay high.

Really sharp breakdown. The point about institutional buyers being a symptom rather than cause is exactlyright - theyre basically betting on local governments continuing to strangle supply. I've noticed even at teh municipal level folks would rather blame Blackstone than look at their own zoning boards. Once that switch flips and cities actualy build, those "smart money" investors will be bagholders.